We are looking for an independent senior editor

Telecom Companies Thwart Over 14 Million Fraudulent Calls in Strategic Crackdown

In a concerted effort to combat the growing threat of identity theft and telecommunication fraud, telecom operators have intercepted over 14 million fraudulent calls and SMS within a span of three months. This significant achievement follows the implementation of a comprehensive government plan, as highlighted by Óscar López, the Minister for Digital Transformation and Public Function, during a session in the Congress of Deputies.

Since the plan's approval on March 7, operators are mandated to block numbers unassigned to any legitimate user or service, averaging 235,600 calls and 10,000 SMS blocked daily. This regulatory framework introduces phased measures to counter fraudulent telecommunication practices effectively.

On June 7, two pivotal measures will be enacted. Firstly, users will no longer receive calls and SMS that, despite originating internationally, falsely appear to come from Spanish numbers—a common tactic in phone fraud. Furthermore, commercial calls from mobile numbers will be prohibited. Such calls frequently originate from unrecognized national mobile numbers, leaving recipients unable to identify the caller. Henceforth, commercial calls must utilize geographic numbers, specific commercial communication numbers, or toll-free numbers like 800 and 900. This change enables clearer identification of commercial calls, with these numbers now authorized to make as well as receive calls.

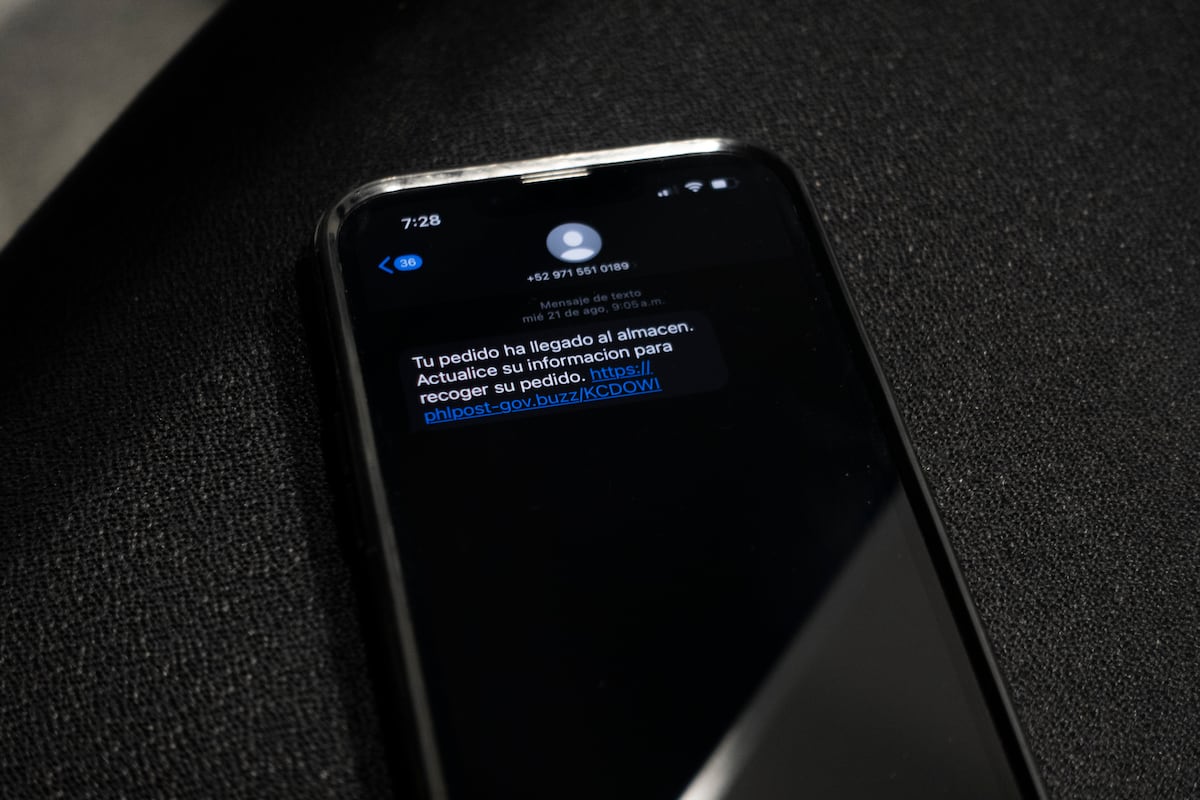

The plan’s final phase involves establishing an official database of alphanumeric codes used by companies and public administrations as SMS identifiers. This technically complex measure will be enforced 15 months post the ministerial order's publication. Managed by the National Commission of Markets and Competition (CNMC), this database will authenticate communications, safeguard legitimate entity identities, and streamline the detection and blockage of identity spoofing attempts. This registry will preemptively block messages impersonating agencies such as Traffic or Postal Services.

In tandem with these security measures, the issue of romantic scams was brought to light by Óscar López during a congressional event on emotional fraud, organized by the National Association Against Emotional Manipulation Fraud (Anceme). This form of fraud, which not only causes financial loss but also severe psychological harm, calls for criminalization under the Penal Code and the establishment of a unified national reporting protocol.

Unlike typical scams, romantic fraud or cyber love scams exploit emotional manipulation and coercion, leading to psychological devastation beyond financial ruin. Victims like Vicente, who lost over €24,000 through a dating app scam, and Jorge, burdened by guilt and societal judgment, shared their experiences in Congress. Their stories underscore the need for a shift in societal perception and legal recognition.

Paz Velasco, a legal scholar and criminologist, dissected this scam's anatomy, labeling it a new form of digital violence exploiting affection. These scams remain unclassified in the Penal Code, limiting law enforcement and increasing impunity. Velasco notes that these scammers are patient predators, investing significant time to build trust before soliciting money. They adeptly identify and exploit victims’ vulnerabilities, such as loneliness or low self-esteem.

The emotional cyber scammer crafts detailed false digital identities and concocts problems to extract money from victims, tailoring narratives to each target. The scam progresses to an "avalanche of affection" phase, where constant declarations of love create an illusion of finding a soulmate. During this stage, scammers deepen intimacy to solicit money, a phase that can last from weeks to over a year. They deceive victims into believing it's time to transition to a physical relationship, though it never materializes, introducing unexpected problems and cycles of abuse.

Victims, once emotionally invested, face fabricated medical issues, sudden debts, or legal problems, manipulated into financial aid. If hesitant, scammers employ emotional manipulation to compel transfers. Eventually, the scam culminates in disappearance or continued financial demands, maintaining victims in a manipulated hopeful state.

Velasco describes the final stage as a devastating realization for the victim—financial loss coupled with the emotional impact akin to grieving a loved one, compounded by profound humiliation.

Under the rallying cry "Change the Shame," Anceme President Blanca Frías initiated discussions with psychologists, forensic psychiatrists, and victims to highlight this burgeoning crime, fueled by the transformation of personal and intimate relationships online.

LEAVE A COMMENT